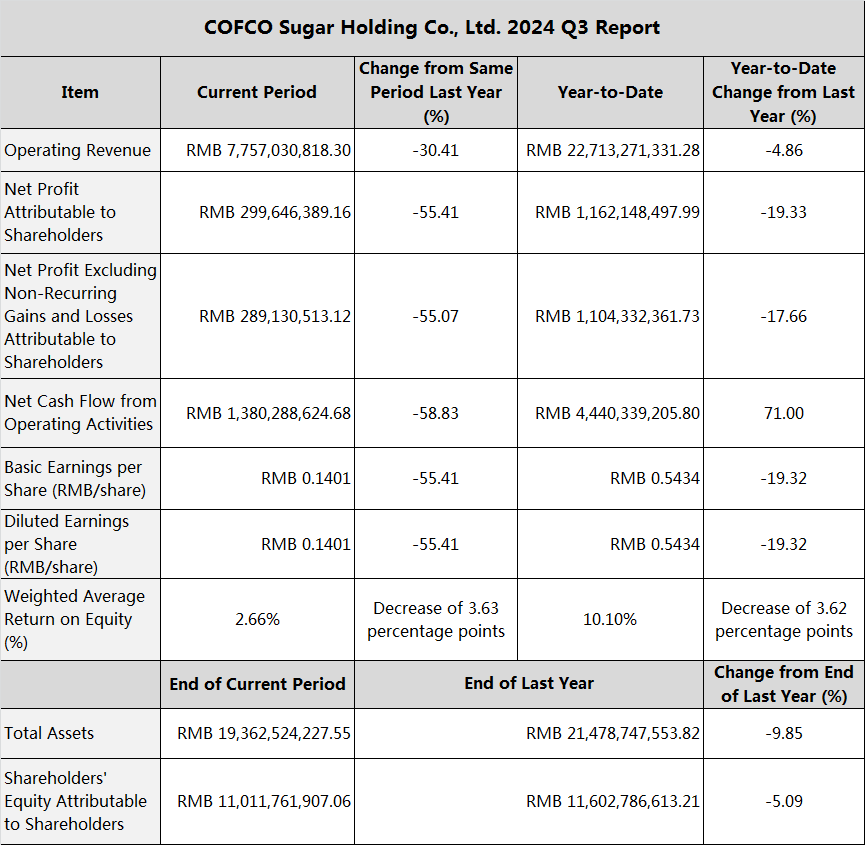

On October 22, COFCO Sugar released its

2024 third-quarter report. For the first three quarters, the company achieved

operating revenue of RMB 22.713 billion, a YoY decrease of 4.86%, with a net

profit attributable to shareholders of RMB 1.162 billion, down 19.33% YoY.

Basic earnings per share were RMB 0.5434.

In the third quarter alone, operating

revenue reached RMB 7.757 billion, a 30.41% YoY decline, while net profit

attributable to shareholders was RMB 300 million, down 55.41%.

Additionally, the net cash flow from

operating activities in the third quarter was RMB 1.38 billion, a decrease of

58.83% year over year.

The report shows that the company's

operating revenue and net profit fell sharply YoY in the third quarter. The

main reason, as explained by the company, is the contraction in the scale of

sugar processing and trade compared to the previous year.

Signs of Decline in COFCO Sugar's Performance

The downward trend in COFCO Sugar's

performance appears to have continued into the third quarter of this year.

According to the company's half-year report, COFCO Sugar's main revenue in Q2

was RMB 7.145 billion, a YoY decrease of 9.9%, with net profit attributable to

shareholders at RMB 422 million, down 14.64% YoY. The gross profit margin

dropped by 13.58 percentage points to 10.42%, and the return on equity fell

from 10.48% to 7.71%. In addition to industry factors, the company's investment

income for the first three quarters was only RMB 26.49 million, compared to RMB

193 million in the same period last year.

Public information shows that COFCO Sugar

is one of COFCO Group's core businesses. It is a major player in sugar

production and importation in China and is also the largest tomato product

producer globally.

Sugar Prices Remain Sluggish

In the second and third quarters of this

year, sugar prices fell significantly compared to the same period last year,

impacting revenue and reducing profit margins for sugar producers. White sugar

futures prices have been volatile this year, dropping by 12.96% from January to

August. However, due to expectations of reduced production, white sugar futures

saw a small rebound, rising by 8.61% between August 23 and October 9. After

this rebound, domestic production for the new sugarcane season will fully

commence in the fourth quarter, which is expected to increase sugar output to

some extent. Under this strong expectation of increased production, sugar

prices may continue to face pressure in the short term.

About CCM:

CCM is the leading market intelligence provider for China's agriculture, chemicals, food & feed and life science markets. Founded in 2001, CCM offers a range of content solutions, from price and trade analysis to industry newsletters and customized market research reports. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.